🔥 Geopolitical Tension, War & the Financial Markets

The recent developments over the past few days have reflected a complex interplay of economic, geopolitical, and market dynamics. The tensions in the Middle East's geopolitical chessboard escalated.

There is uncertainty in the global economic and market outlook due to factors such as the conflict between Israel and Hamas and existing economic challenges like inflation in the US.

First, let's review what's happening in the geopolitical landscape before diving into the financial markets.

Please bear with me, and I'll go after the financial markets after covering what has happened over the past couple of days.

US inflation

Recent data shows a slight easing in US inflation, with consumer prices rising by only 0.4% from August to September 2023, which is lower than the previous month's 0.6% pace.

Although inflation pressures remain evident, wholesale prices rose 2.2% in September 2023, marking the largest year-over-year gain since April.

Middle East tensions

The conflict between Israel and Hamas has intensified, resulting in numerous casualties and extensive destruction in Gaza. The geopolitical situation has become more complex, with Iran warning Israel against further escalation and the possibility of involvement from other regional actors.

The United States Secretary of State, Antony Blinken, has been engaging in shuttle diplomacy to prevent further escalation in the Middle East.

So what does that mean? It means he has been traveling to different countries in the region, meeting with different leaders to discuss the situation in a hopeless attempt to find a peaceful resolution. During his visits, he has been discussing the conflict and working to fund ways to get humanitarian aid into affected areas and other diplomatic attempts.

The ongoing conflict has raised international concerns about the possibility of other countries getting involved, which could result in a wider regional conflict. This situation could have serious implications for peace and economic stability in the Middle East. If the conflict causes oil prices to rise, it could lead to global inflation.

The US has warned Israel that occupying Gaza would be a mistake. Secretary Blinken is trying to mediate to avoid escalation.

Failure to contain tension

Acts of violence already happened in Belgium during a soccer match between Belgium and Sweden. A man claiming allegiance to the Islamic State targeted Swedish nationals, leading to two individuals' deaths. Why Swedish nationals? I didn't read much more into it, admittingly, but there was speculation due to the burning of the Koran in Sweden.

The US has taken a supportive stance towards Israel while bolstering its military presence in the Middle East. Iran, on the other hand, believes the US is already militarily involved and holds it accountable for the ongoing violence.

China proposed to mediate the Israeli-Palestinian conflict and has engaged with both sides.

Russia urges a diplomatic solution, emphasizing the need for a ceasefire. Its balanced stance is due to its long-standing relationships with Israel and Palestine and its desire to expand its influence in the Middle East.

As a deterrence measure, US military assets, including two Navy carrier strike groups, were deployed to the region to showcase their involvement in the unfolding conflict.

A visit of Biden to Jerusalem, if realized, would signal a high level of US engagement. Iran's and Russia's roles, alongside the US and China, show a complex geopolitical landscape, which you and I can't even comprehend, even though we all like to see ourselves as experts now.

The incidents of violence and the involvement of major powers in the Israel-Palestine conflict have elicited global reactions, from diplomatic engagements to public protests and extremist acts, indicating the far-reaching impact of the crisis.

Cold War era throwback

So, when we peek at the recent Israel-Palastina conflict, it's like watching a high-stakes drama with a cast of powerful characters from around the world. Each of these players, namely the US, China, Russia, and Iran, has its own set of interests and buddies in the region.

Team US: The US has traditionally been on good terms with Israel. Sending 2 Nava carrier groups is like saying: "We got your back."

Team Iran: Iran is backing Palestinian groups like Hamas. They're not happy with the US's close friendship with Israel.

Team Russia: Urging everyone to stop the violence and talk things over, which is ironic. They've got friends on both sides and are hoping to play the peacekeeper, probably to score some points in the Middle East.

Team China: Offering to mediate between Israel and Palestine and hosting their leaders. They're eyeing a bigger role in the Middle East, which could shake things up.

You may wonder why this is a throwback to the Cold War era. Back then, big showdowns often had the US and the Soviet Union backing opposite sides, each pushing their own agenda.

Today has a similar "vibe: with major powers aligning with different sides in the local conflict, which could ripple out and affect the bigger global picture.

It's like a chess game with nations moving their pieces across the board, stretching from the Middle East to the far corners of the globe. Each move can shift balance, spark reactions, and may even draw more players into the fray.

Can the United States support its allies militarily and economically amid rising geopolitical tensions while managing its internal economic challenges?

- Ukraine: US Treasury Secretary Janet Yellen affirmed that support for Ukraine remains a top priority, emphasizing the importance of robust economic aid and unveiling a new military assistance package alongside Israel exceeding $2 billion.

- Israel: Though not discussed in detail during Yellen's meeting with the Eurogroup, she acknowledged the US's ability to stand by both Ukraine and Israel amid the escalating crisis in the Middle East/

- Taiwan: While the focus has been more on Ukraine and Israel, recent developments show a bundled aid proposal for Israel, Ukraine, and Taiwan, indicating the broader scope of US support to its allies.

Yellen's argument reflects a Keynesian economic perspective. She believes that the economy has a spare capacity, and the government can absorb it through higher spending. She downplays the concerns around debt interest and seems overconfident about the US's economic capability to support its allies.

The United States may have the financial resources to participate in two or three military conflicts. Still, it does not have the physical means to manufacture the required supplies for such engagements on a larger scale for an extended period. Any attempts to do so could result in higher inflation, similar to what was witnessed during the COVID-19 pandemic, especially when endeavors are made to bring back the production onshore rapidly.

THE ARTICLE DOES END HERE. SCROLL DOWN FOR THE MARKETS REVIEW

Are you a premium newsletter member but still haven't joined Discord? (The article does not stop here)

Join Discord to get the full value out of the newsletter. There's no extra cost associated with Discord. Yes, options data, such as dark pools, options gamma, unusual flow, etc., are also included. Also, educational content, reports, and direct questions to me, and often, I share my trades & thoughts in real-time as the market moves.

However, I want you to understand rather than copy a trade.

The unwinds

On Tuesday, October 17, multi-asset funds in New York showed unwinding activities, causing both bonds and equities to sell off simultaneously.

Underlying market actions hint at unwinding, with Mega Cap Tech and AI stocks driving the downturn, while profitless Tech and lower-quality credits are showing a squeeze despite the rising rates.

Consumer and Discretionary stands out as a top performer due to the short-squeezes in retail. Signs of distress are evident in baskets with High "short interest" exceeding the Hedge funds Holdings basket (a basket or group of stocks commonly held by hedge funds) by over 100bp (1%), and the VMware, Inc. and Broadcom Inc., spread is expanding, causing discomfort.

The intray momentum shift prompts queries about its bullish implications. Despite the rapid rate movement concerns, a notable flow shift was detected. Initially, the UBS desk was selling but shifted to buying as the market rebounded.

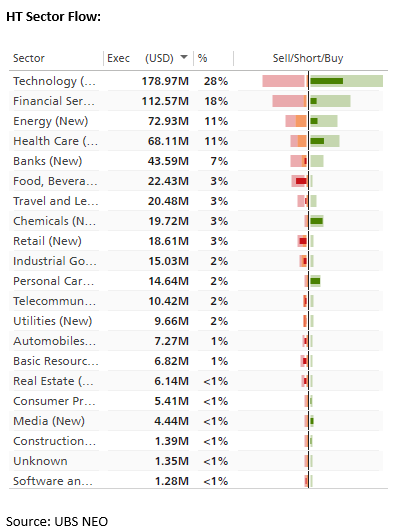

Hedge fund positions are 63/25/10 for Buy/Sell/Sell short, and long-only positions are split at 48/52 for Buy/Sell.

So 63% of hedge fund activities are oriented toward buying stocks, while 25% are aimed at selling/offloading stocks they already own.

Long-only positions are investment strategies that involve only buying and holding stocks without trying to short. 48% of long-only activities are directed to buying stocks, while the remaining 52% are selling/offloading stocks.

Initially, financials and banks were being sold off, but banks have now stabilized, and financials are in demand. Healthcare and energy sectors are seeing buying while staples continue to be sold.

Macro factors are still pivotal, with upcoming speeches from the Fed and ongoing geopolitical tensions playing a role. Elevated activities in systematic and multi-asset funds usually impact ETF and futures, which we saw last session.

USD/JPY

At the beginning of the week, many believed that the US dollar (DXY) would weaken against the Japanese yen for several reasons.

There were hints from the Federal Reserve about a possible end to rate hikes. Ongoing military conflict in Israel caused concern, leading some investors to adjust their positions, which could affect currency values.

However, the recent remarks from the Federal Reserve are a continuation of their existing policy rather than signaling a shift.

The recently released Non-Farm Payroll data from September seemed strong on paper, indicating a healthy US economy that could potentially support a strong dollar. While there are discussions in the media about possible Israeli military operations in Gaza, it is unlikely to immediately impact the USD/JPY exchange rate unless there is a significant escalation in the Israeli conflict that could lower US yields.

Last but not least, I do not anticipate any changes in the Bank of Japan's policy until the end of 2024. This is in contrast to some market predictions that we see on Twitter suggesting the Negative Interest Rate Policy (NIRP) will end soon.

Some more FX

Rates

Tech risk & volatility

This year, technology stocks have displayed a behavior different from their usual trend, which is influenced by macroeconomic factors. This change is not only impacting the market's stability due to the tech industry's resilience but also contributing to the equity volatility of VIX remaining stable.

This can be attributed to the considerable weight of tech stocks in the index and their distinct market behavior.

Even though the economy's been doing better than we thought this year, RTY hasn't been keeping up with the S&P.

And you know how people usually think the Nasdaq gets jumpy when rates go up? Well, that hasn't been happening as much as it used to.

To top it off, some recent events just add to the weirdness. Like on 6-Oct, S&P futures took a 1% hit because of a surprise jump in job numbers. But then, out of nowhere, they bounced back by 2.4%. Honestly, who saw that coming?

Last Thursday (12-Oct), when we all expected the Tech sector to tank because of history, it actually went up?!

Since 1990, there've only been 6 times when RTY dropped more than 2% and 30Y yields jumped over 15bps on the same day. And on those other five days? The S&P Tech sector was down big time, somewhere between -1.8% and -4.5%.

Historical Data Points

- All days since 1990 where RTY is below -2% & 30Y yields exceed 15bps:

- Dates: Aug-90, Mar-96, Jan-09, May-09, Jun-22, Oct-23

- S&P Tech vs. Russell 2000 trends are shown.

- S&P futures from 7:00 AM to 4:00 PM, with a notable October NFP print at 8:30 AM, display a -1.1% to +2.4% change.

Tech's influence on both realized and implied correlation is significant. Hence, there's a growing interest in employing Tech-based hedges to shield portfolios against a potential alignment with macro risks.

The recent buzz around volatility-based hedges is worth mentioning, especially after the movement in the VIX on October 13. Despite just a 0.5% drop in the SPX500, the VIX jumped by 2.6 vol points, reflecting a beta over 5. A deviation rarely seen

VIX call option volume on the same day, reaching 1.37 million contracts, nearly matching the peaks before the volatility spike on February 18

On Monday (16-Oct), the VIX cooled down mainly because things didn't heat up in the Middle East over the weekend. But, if you ask us, keeping some VIX in your pocket might be smart.

Why? Because everything's going a bit too smoothly right now (some call it a "Goldilocks" scenario).

But if geopolitical tension worldwide escalates or the bond market remains wild, we'll want VIX calls as a hedge.

Trade ideas from BofA

- Buy the QQQ November 360-350 put spread for $2. This offers a maximum payout of 5 times the investment. (Reference price for QQQ: 368)

For a more convex hedge:

- Buy the VIX November 20-30 call spread for $0.87. (Pricing is based on the November VIX future value of 17.89)

Become a Premium member. Premium newsletters & Discord community access

Join Discord to get the full value out of the newsletter. There's no extra cost associated with Discord. Yes, options data, such as dark pools, options gamma, unusual flow, etc., are also included. Also, educational content, reports, and direct questions to me, and often, I share my trades & thoughts in real-time as the market moves.

However, I want you to understand rather than copy a trade.

ApeX DEX

ByBit has made KYC mandatory as many other exchanges. Why not try out ApeX DEX? You can use your wallet or social account to use the DeX. No gas fees are required for trading & the fast trading experience is like a CEX.

Consider ApeX DEX

Instructions:

https://twitter.com/RNR_0/status/1652360705331347461

For a lifetime fee discount, check the link.

Signup: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

Ref code: 46

Also, you can use your socials like Gmail/Google, Discord, etc to login on to ApeX Dex if you're too lazy to many a wallet such as Metamask or blockwallet