Market insight, July 19, 2022

With options expiration in the rearview mirror, there are few critical events before the end-of-month rebalance.

When investors rebalance, they readjust their portfolio weightings to put them back in line with their desired asset allocation.

Given the outperformance of equities markets over fixed income MTD, rebalancing is probably a minor cause of selling (month-to-date). That indicates that equities have performed better than bonds so far this month. Therefore investors may sell some stocks to rebalance their portfolios by buying more bonds. However, this selling is expected to be limited, given that equities markets have outperformed bonds over the last month.

What is Rebalancing?

Typically, this occurs after each month. For instance, an investor's portfolio may consist of 60% equities and 40% bonds. A month later, however, the stock allocation may rise to 65%, owing to the stock market's success, while the bond allocation falls to 35%.

To rebalance, the investor would sell a portion of their stocks and use the proceeds to purchase more bonds, returning them to the targeted 60/40 ratio.

If you have never heard of rebalancing, it's worth checking out. You could design a portfolio that would beat the buy & hodl strategy.

For instance, holding bitcoin, gold, ethereum, Solana & cash with the desired allocation. Your desired allocation could be 50% bitcoin, 20% gold, 20% Solana and 10% cash. Prices will fluctuate, and your portfolio will be out of balance. If Solana jumped in price, maybe Solana will consist of 30% of your allocation now. It would help if you rebalanced by selling 10% of your Solana for bitcoin, gold, and cash. So that your original 50/20/20/10 allocation is back.

A great video

I'm a little bit late for writing this in a blog post.... I mentioned in a tweet that it's worth looking into Netflix. Sell the bad earnings rumor and buy the news.

Double dare, buy Netflix after disappointing earnings report

— Romano (@RNR_0) July 19, 2022

Overall market

The first half of 2022 has passed and has been the worst start to equities markets in the last fifty years. What started in January as tax selling has turned into another horrible year but this time not only with a pandemic but also inflation, hostile monetary policies, war, the economic collapse of other countries, and starvation.

Since the majority of SPX stocks are down, there is potential for the market to decline more if we have another leg down. On the other hand, some argue that a substantial deal of damage has already been done and that steep discounts may provide advantageous buying opportunities. Perhaps risk assets have bottomed? Or at least we can expect a bit more juice from this current short squeeze.

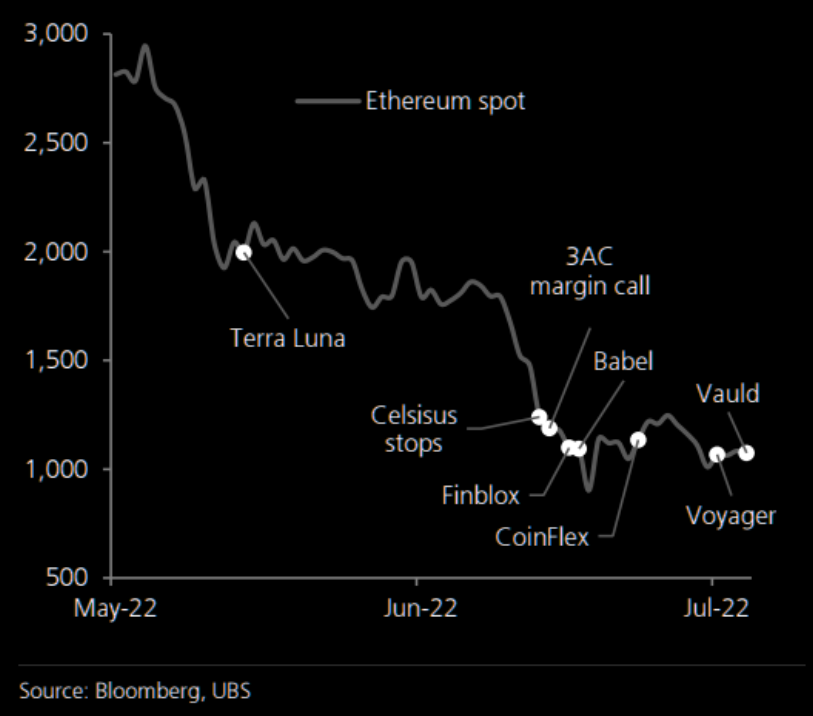

For the crypto

Maybe Sam does have a point

— Romano (@RNR_0) July 12, 2022

pic.twitter.com/C9s2vsRqvB

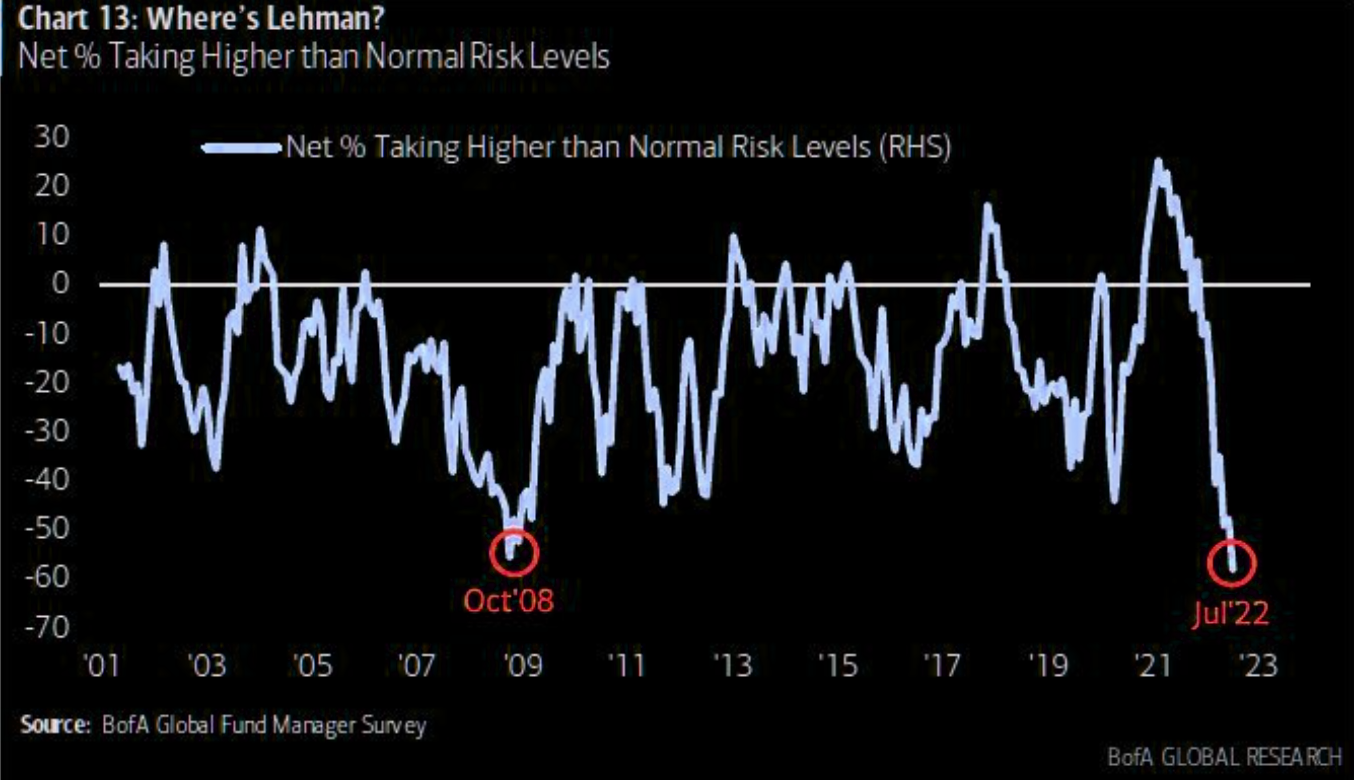

BofA fund manager survey

The most recent poll of fund managers conducted by Bank of America reveals that investors are growing more risk-averse and liquidating holdings in risky assets. As the demand for riskier assets decreases, this might indicate that the present market cycle is reaching its conclusion.

One could argue, "Who would buy at these levels," but you can also ask the question, "Who's left to sell?"

VIX

The VIX expiry is tomorrow, and the market has historically seen implied volatility rising. Nonetheless, possibly rising implied volatility (IV) levels might generate headwinds for the equity market ahead of the FOMC meeting next week on July 27.

While the market may be good today, there may be some volatility the following week. When implied volatility starts to rise, so do "put option" prices. Since dealers, market makers, and liquidity providers are on the side of trades, in this case, they would be "short puts." These "short put" positions would go against them, and they will have to rush selling shares to get back to delta neutral. If prices fall, they may have to chase the market down and sell low and lower, creating a feedback loop.

Bear market rallies

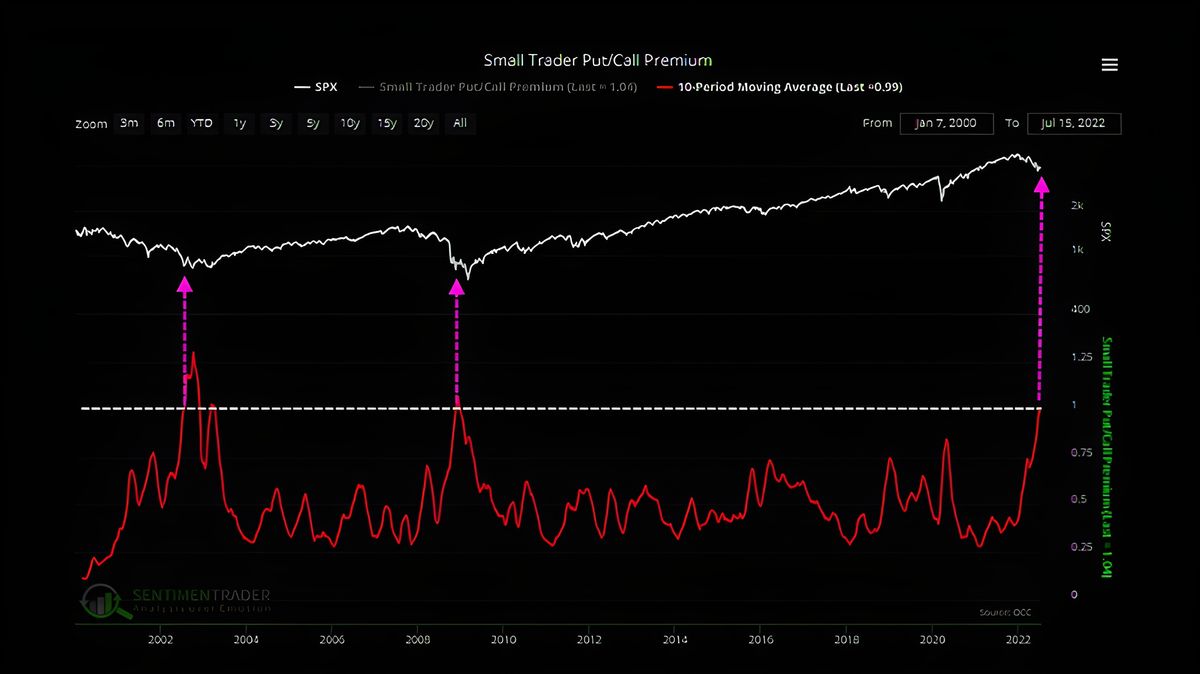

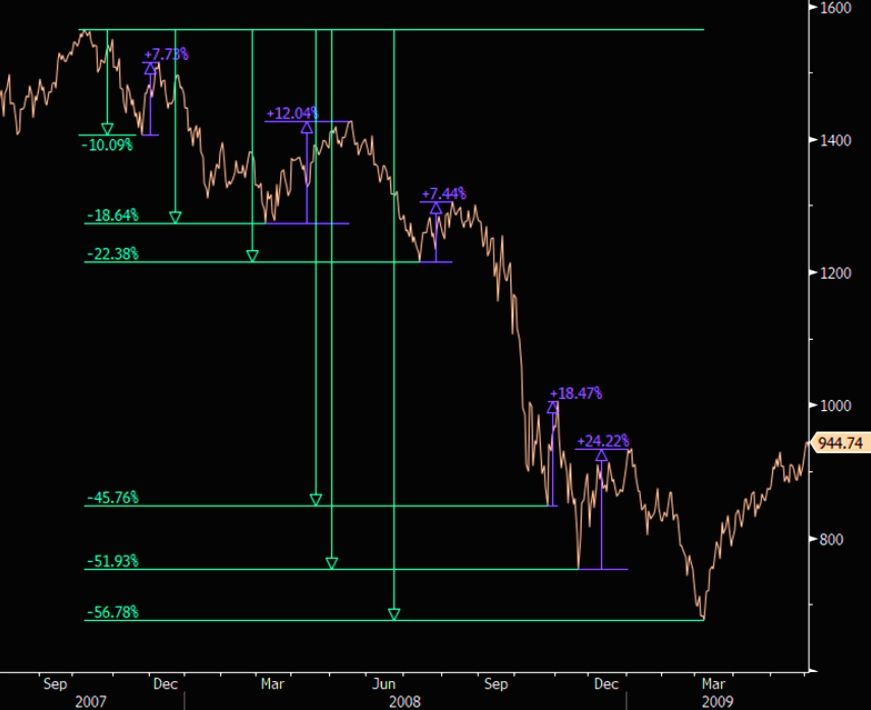

"Bear market rallies tend to get bigger the more prolonged the bear market continues, so we could see a significant rally at some point. However, it's important to remember that we are still in a bear market, and the magnitude of the fourth squeeze in bear markets between 2002 and 2008 was 21% and 19%, respectively."

-As noted in my older article

Bear market rallies 2000-2002 and 2008-2009

And now we have another bear market rally.

Unlikely to be the bottom, I mean, it would be too good to be true, right? If it is the bottom, I would be truly surprised and happy. I keep both options open.

Hopium

Now I could also provide you guys with some hopium.

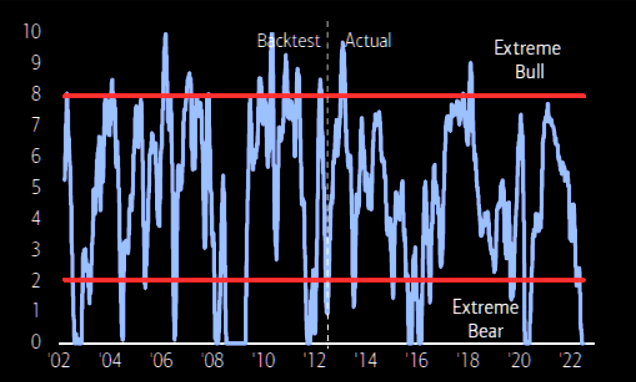

Hartnett's sentiment indicator signals that now is a good time to buy, although he admits that he has been saying this for a few weeks. "Timing is always difficult," but Hartnett's indicator suggests that now is a "good time to buy".

Yeah... take it with a grain of salt. Not financial advice on this one. Timing is art.

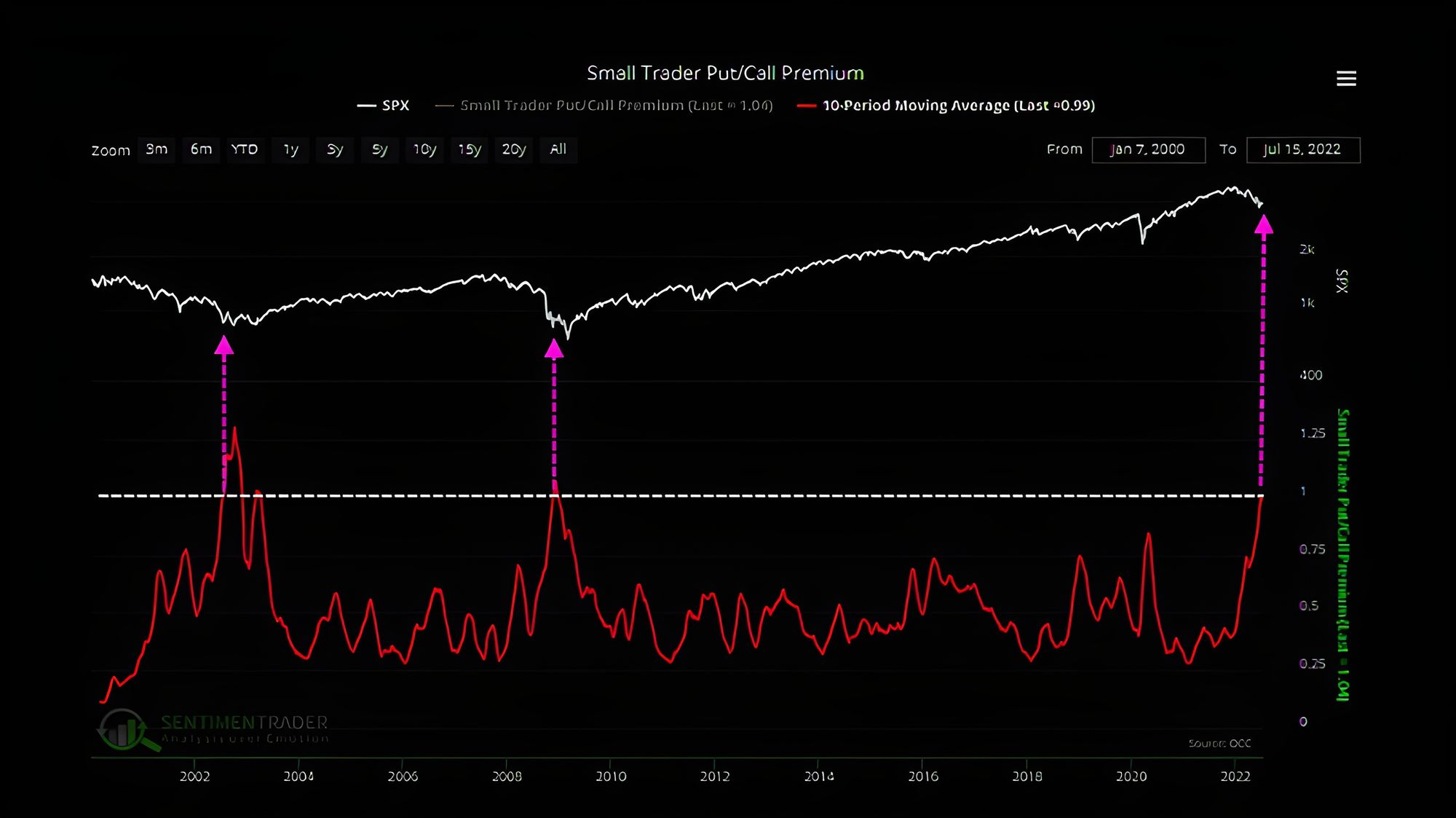

Small trader put/call premium.

One possible explanation for the recent behavior of small traders is that they believe the market will become more volatile in the near future. By buying both put and call options, they are hedging their bets and preparing for a market move in either direction. That is an unusually large amount of money for small traders to be spending on leveraged, expiring bets, which suggests that they are confident about their predictions.

"Over the past ten weeks," small traders" have spent $39.7 billion on put options and $39.6 billion on call options. It's extremely rare for them to spend more on leveraged, expiring bets.

The bears must hope that this time will be different.