Market insight June 13, 2022

The central bankers have managed to shock the markets out of their complacency, and it is hard to estimate how severely they aim to continue torturing us. From the equities markets, shockwaves are sent to the cryptocurrency markets.

Central bankers have caught markets off guard, and it is no longer clear how far they are willing to continue their "noble quest"......

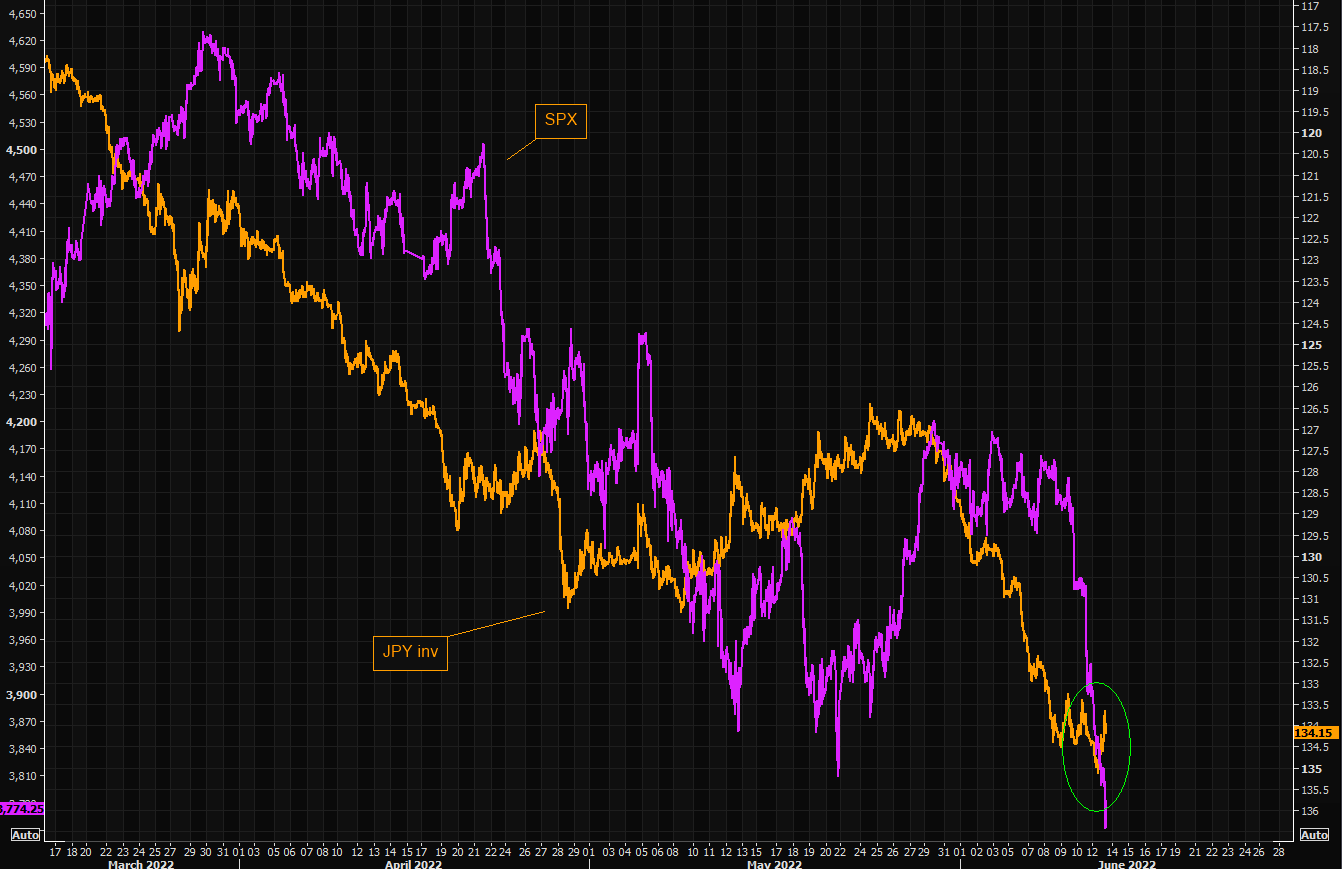

To try to tame inflation by killing the consumer rather than encouraging supply expansion, and FX markets (especially in Japan) seem to be signaling a major event is underway.

Even though the JPY has reversed course recently, it is still something to watch closely. That is because when the JPY was crashing, it had serious implications for the world economy, and those same implications could still occur if the JPY were to crash again.

So the equity markets are going down, interest rates are going up, and this is due to central banks' efforts to stop inflation. That might be having the opposite effect of what they intended, as it is depressing consumer spending. Additionally, Forex markets signal that a significant event is about to happen.

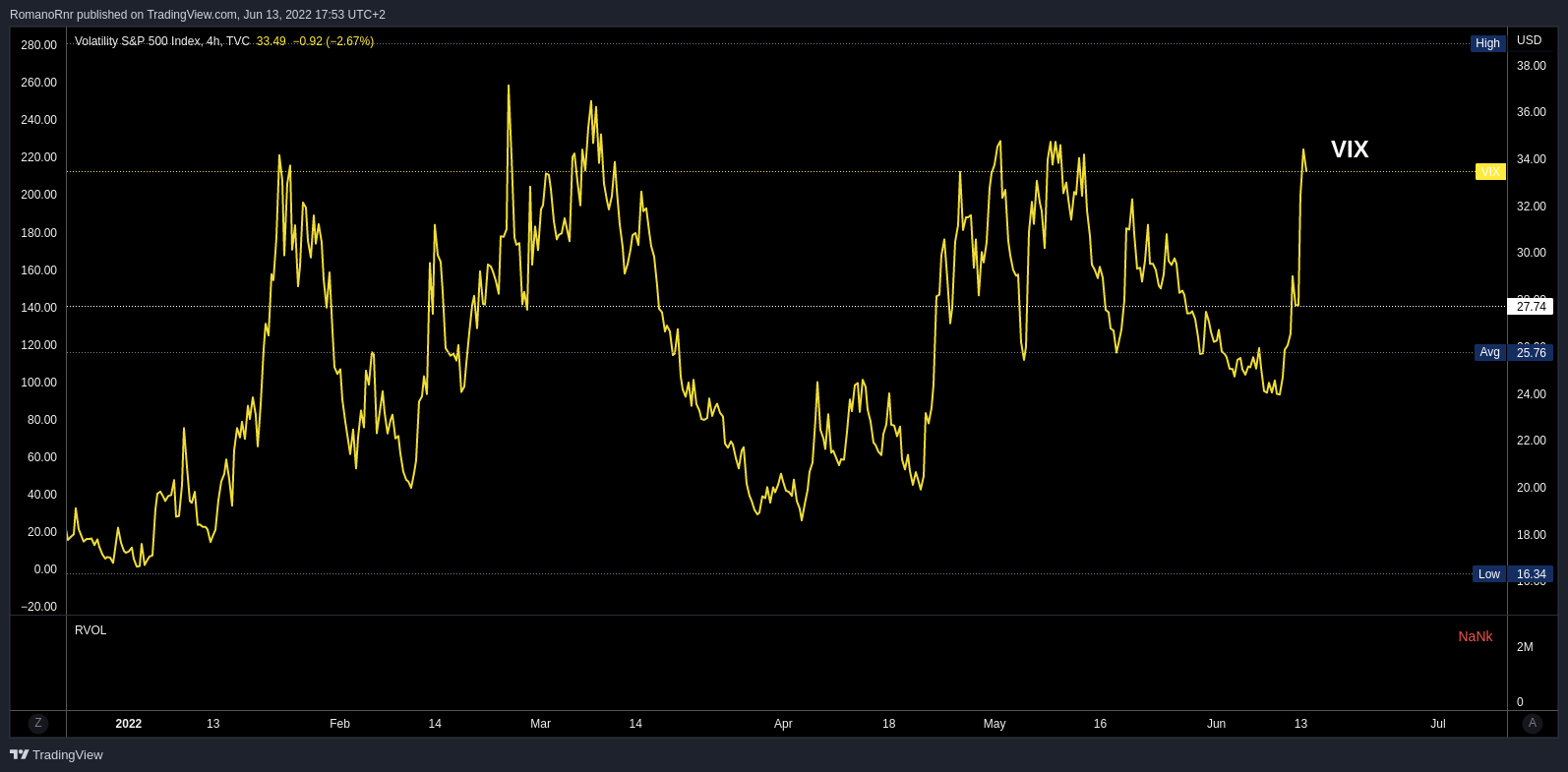

VIX

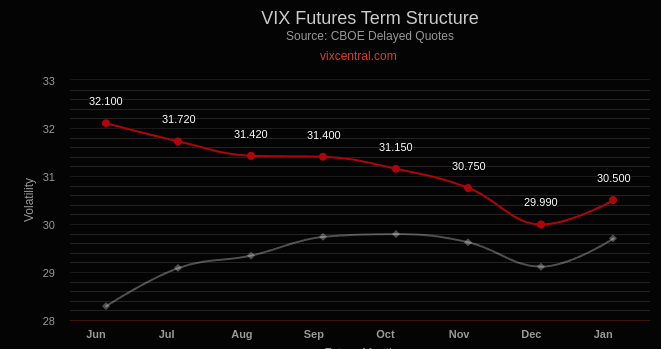

The VIX measures market volatility, and the VIX futures contract expires on Wednesday. The VIX jumped from 24 to 33, which is almost an increase of 40%

Before this, the market had gone up a lot on the Tuesday before the VIX expiration date twice, in April and May. That is less likely to happen again, though. That's because the VIX term structure has shifted from contango to backwardation.

When the VIX is in contango, that means that longer-term VIX expiration dates are higher than shorter-term ones. That typically happens when there is less volatility in the market.

When the VIX is in backwardation, that means that longer-term VIX expiration dates are lower than shorter-term ones. That typically happens when there is more volatility in the market.

If the VIX Index stays near 32.1 or above, the price of each of these futures contracts for different maturities will "slide up the curve" over time.

Short VIX futures traders will lose money Traders who are long VIX futures or bullish on volatility products, on the other hand, are likely to profit.

So, the VIX term structure is now in full-blown backwardation as investors buy short-term protection in panic.

Investors buying short-term protection in panic are that they are expecting increased volatility shortly. That could be due to several factors, such as an upcoming earnings release, a macroeconomic event, or simply a correction in the stock market.

However, they had the chance to buy protection cheaply. Buy insurance when you can, not when the building is already on fire.

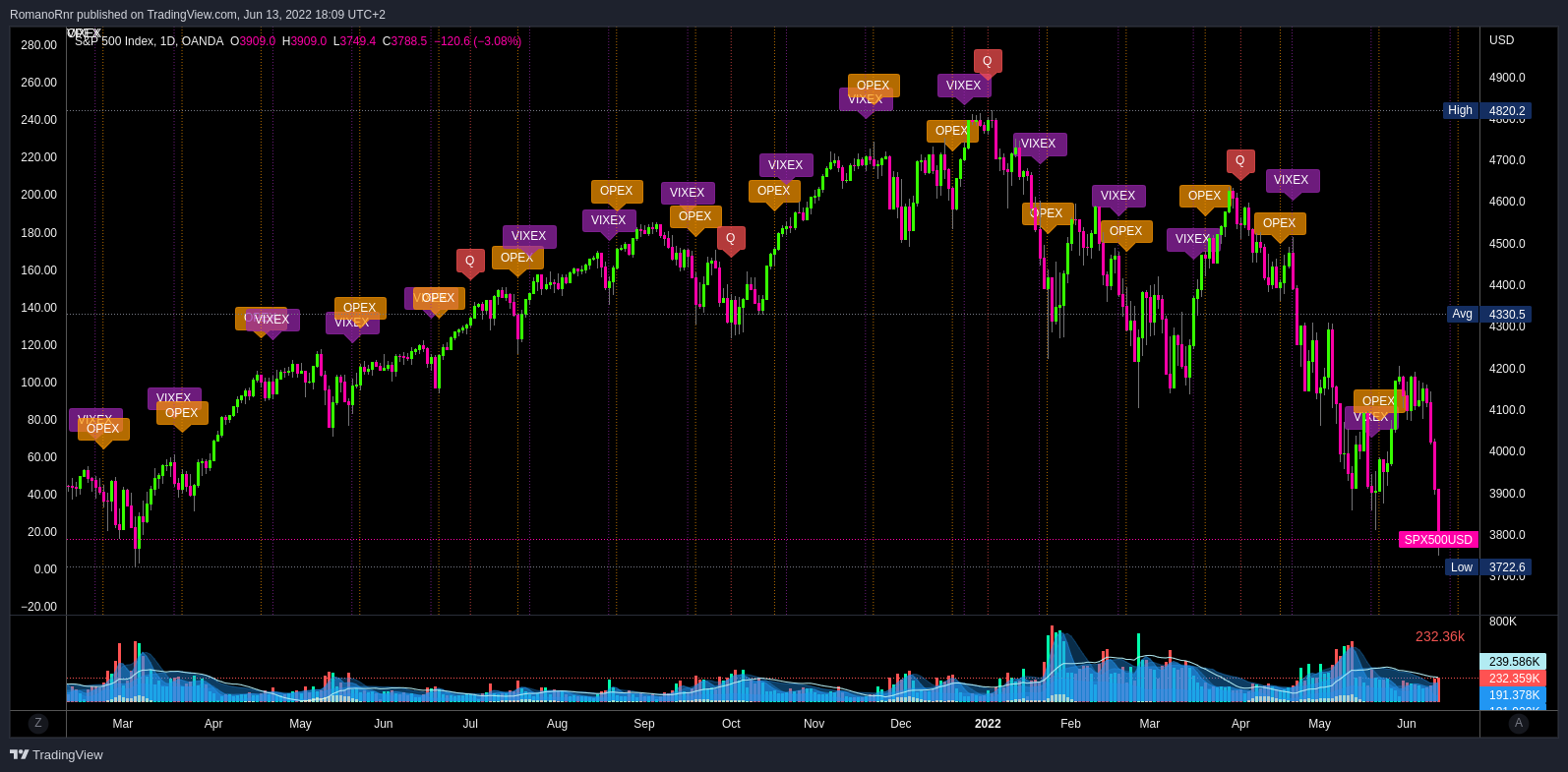

OPEX

Okay, so it seems most people don't know what I mean when I tweet about "OPEX," but let me clarify this.

OPEX is the Options Expiration Date, the day on which options contracts expire.

Let's cover options put delta first:

The "put delta" is the amount by which the price of a put option changes in relation to a change in the underlying asset price. A put option with a delta of 0.5 will increase in value by $0.50 for every $1.00 decrease in the underlying asset price.

The more the market falls into OPEX (Options Expiration Date), the more "put delta increases."

Okay, so those put options increase in values, so what? Remember, market participants bought those put options from the market maker/dealer, and they now have the opposite position since they have "short-put" exposure.

If the market's "put delta" grows, the probability of a market decline increases. That will result in higher hedging by dealers, which will raise the amount of hedging that must unwind when entering or exiting OPEX.

Let's say a market participant bought a put option with a delta of -0.2, and slowly as that put option reaches the "strike price" and has a delta of -0.5

However, the dealer is now stuck with the opposite. He has to sell shares as the market drops lower and chase delta to stay "delta hedged." When being "short-gamma," he has to sell low and buy high to chase delta. By selling a "put option," he gained a positive delta of 0.2 and negative gamma.

However, as those put options become more "in the money" and the delta of those puts grows, the dealer has to chase by selling more shares.

Remember that term "gamma squeeze" when hedge funds had to buy the underlying chasing higher prices to stay delta hedge. Yeah, this is a scenario of the opposite.

Due to the higher Fed event risk, the additional hedging activity will boost the chance that options will maintain their value until Friday's FOMC meeting.

The recent decline in the S&P from $4150 to $3800 has increased the June 17 put options. Time decay and IV probably persist until the FOMC statement.

So what about the Fed Event risk?

The Fed event risk refers to the possibility that the Federal Reserve could announce something that would impact the market.

An interesting note is that the lower equity prices fall before the Federal Reserve's meeting (FOMC), the more hawkish the Fed will need to be to cause a sustained sell-off. In other words, if equity prices have already dropped in anticipation of higher interest rates, the Fed would need to raise rates more than expected to trigger another wave of selling.

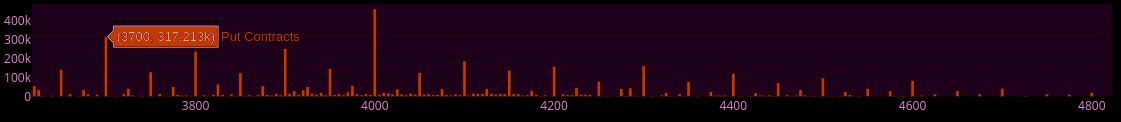

S&P500 3700 puts

The significant number of options that expire on June 17 with a strike price of $3700 suggests the potential for increased volatility surrounding the FOMC announcement on Wednesday.

The S&P500 $3700 strike price will serve as the market's lower limit, with option flows turning from "inducing" to "reducing" volatility. That indicates that the market is anticipating a decline toward the 3700 strike price.

Why would the options flow shift from "inducing" volatility to "reducing" volatility?

The options flow would shift from "inducing" volatility to "reducing" volatility because the market expects to move lower into the $3700 strike price.

If the market moves lower, the demand for options decreases, so the options flow shifts from "inducing" volatility to "reducing" volatility.

The expiration of options will invoke a rally, but the timing will depend on the reaction of the FOMC. The market will see a rally on Thursday and Friday if they are mild.

However, if the Fed causes further selling on Friday, the market will likely have a low on Monday, followed by a rally early next week. That is due to (OPEX) the expiration clearing out a lot of equity "put option" protection.

Nasdaq 2002 vs. 2022

The current market situation resembles the past. In 2002, the market had fading rallies and remained falling. Many struggled as they tried to catch a falling knife. The graph compares 2002-2022 NDX.

SPY & QQQ

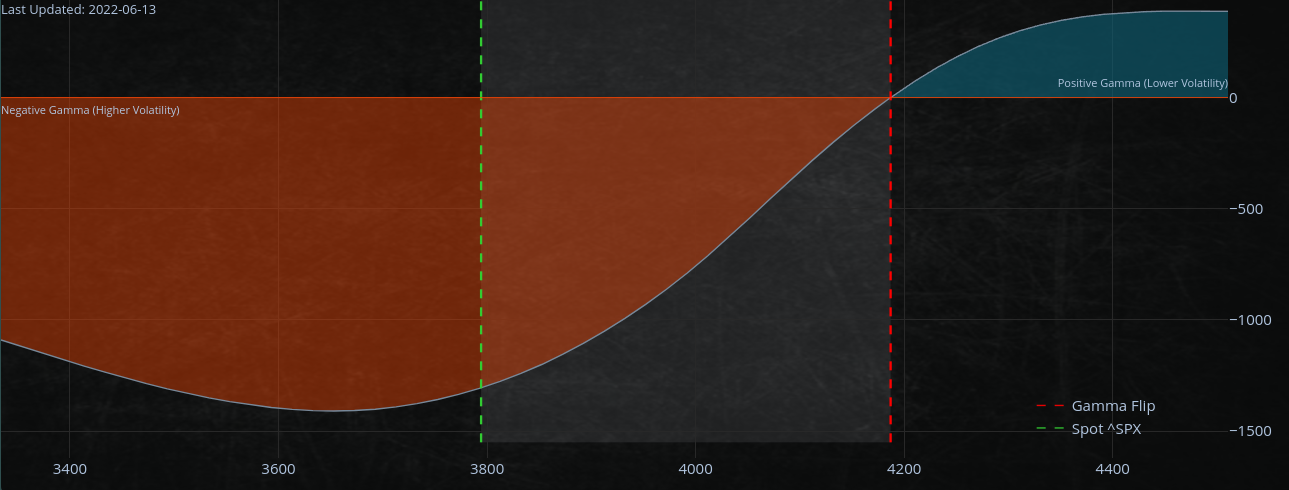

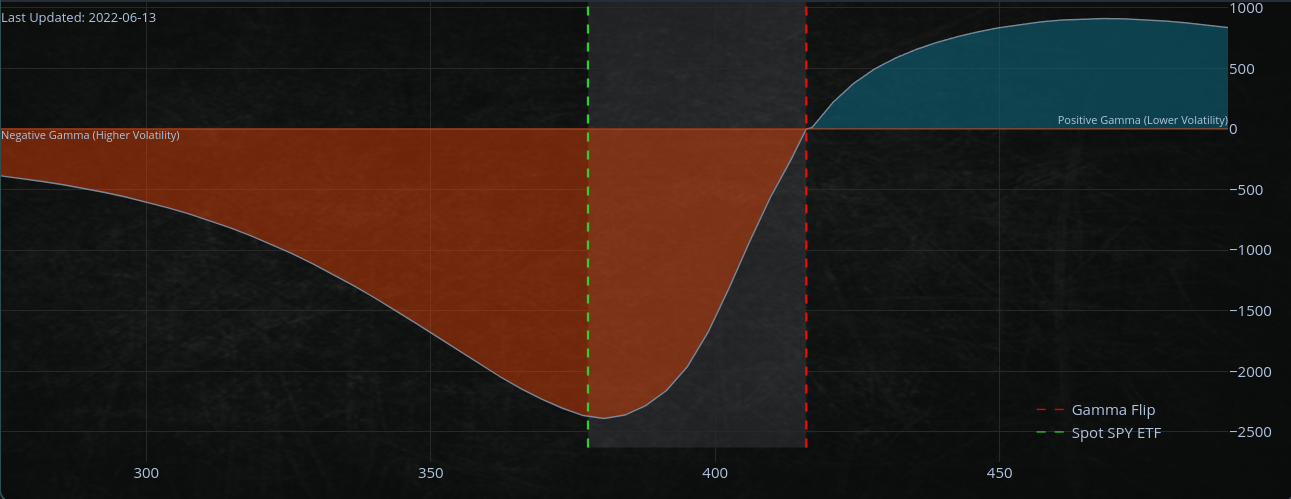

Both SPY and QQQ are now in 'deeper' short gamma territory, meaning dealers have to sell more deltas as the market falls. (as explained before)

That makes them increasingly long on the way down, and the same will happen in reverse if the market bounces back.

The current situation is unstable, and given the poor liquidity, it's difficult for firms to rebalance their portfolios.

SPY

QQQ

- Rallies or relief pumps leading up to the June 17th OPEX should be labeled as "short-covering" psyops and thus susceptible to failure.

- June 15th VIX expirations

- Maybe the wonders aren't out of this world and the S&P500 hits $4300 (no more negative gamma) but I doubt that

- Monitor S&P500 $3700 level as our downside support