Market newsletter Feb 2 - 2023

The market is challenging the Federal Reserve once getting. Aligned with market expectations and discussed in the last newsletter, the Federal Reserve did another rate by 25 basis points instead of their previous aggressive rate hikes.

So it seems like the Federal Reserve decided to slow down the tightening pace for now. At the same time, market participants focused on Jerome Powell's "dovish" statements for acknowledging "disinflation," despite the statement's implications that more rate hikes will be required.

So to make it more clear, Jerome Powel has admitted that inflation may be slowing down. Since the Federal Reserve stated its goal of maintaining rate increases to a moderate level of inflation in the economy. That's a bit strange since that's the opposite of their goal.

The markets saw the statement of a possible slowdown in inflation as a signal that the Federal Reserve may pause rate hikes before inflation reaches the desired level, which drove the intraday session sentiment.

The SPX500 & Nasdaq are both for today and this year. The mood of day traders has shifted. How the market will respond to the Federal Reserve's next decisions and how far market participants are ready to push back and "fight the Fed" will become apparent in the coming days.

Premium subscription

Tired of seeing low-effort content on Twitter with random people posting lines on a chart?

Maybe subscribing to this newsletter is something for you to gain an edge over the market.

Read this content, and give your wife the impression that you actually know what you're reading instead of being a compulsive gambler using "Technical Analysis" (Astrology for men) only.

Also, read my free medium articles: https://medium.com/@romanornr/

Full access to exclusive premium content

Subscribe, and get a competitive edge over the market.

Take the first step to kick your wife's boyfriend out of the house & stop getting liquidated.

US Debt Ceiling

Tension is rising as the US Treasury approaches closer to the debt ceiling of $31.4 trillion dollar. The House and Congress remain divided on tackling the debt ceiling problem.

Yes, the chance of the US Treasury default is low, but markets can experience some volatility if the debt ceiling problem isn't resolved anytime soon.

Similar to what was seen in 2011 when the US credit rating was temporarily downgraded due to similar circumstances showing the fragility of the financial system. As decision-makers struggle with the debt ceiling issue, investors will pay close attention to see how it will be handled and what effect it will have on the markets.

For anyone who doesn't know what the debt ceiling is, I think I can give an oversimplified explanation, so here it comes.

The debt ceiling is the maximum amount of debt the US government can legally borrow. The debt ceiling set by the Treasury is currently capped at $31.4 trillion; when that limit is reached, the government can no longer borrow any more money.

Congress and the House of Representatives need to agree on raising the debt ceiling and avoid any potential economic fallout/default. That would put a limit on how much the government can spend and can help ensure responsible borrowing and spending. However, if the limit is not raised in time, it can lead to volatility, as the US credit rating could be temporarily downgraded.

Japan YCC

At the Bank of Japan's (BOJ) January 18th meeting, the central bank left its "Yield Curve Control" (YCC) policy unchanged. That is not really what many analysts and investors had been hoping/predicting since they were hoping for a further shift toward the YCC policy normalization following a surprise announcement in December about widening the YCC range.

The Japanese yen dropped around 3%, and the FX market signaled a disappointment by the lack of further normalization.

While the yen may have disappointed, the announcement positively affected the Japanese equity market. Japanese equities saw a relief rally.

Bank of Japan (BoJ) may have decided to keep the YCC policy the same since at least some market watchers and investors see it as positive for stocks.

EURUSD

Even though there were no changes to the statement's forward guidance at last night's Federal Reserve meeting, the press conference skewed dovish by repeatedly expressing disdain for disinflation and a lack of concern about financial conditions.

Since EURGBP has been trading at its highs, the British pound is vulnerable to today's BOE message of optimism and force.

(At the time of writing this, it's a bit too late for this)

Expect EURUSD to break beyond 1.0920, with ~1.12 being a final target (for now). There are likely to be two camps of investors: bullish ones who haven't moved yet but are growing anxious, and pessimistic ones who enjoy the narrative of the euro going higher but have found it difficult to max out. If the euro ends the week above 1.10, tensions will rise on both sides.

This is a continued version of my previous newsletter, which you can find here: https://www.romanornr.io/market-research-jan-30-2023/

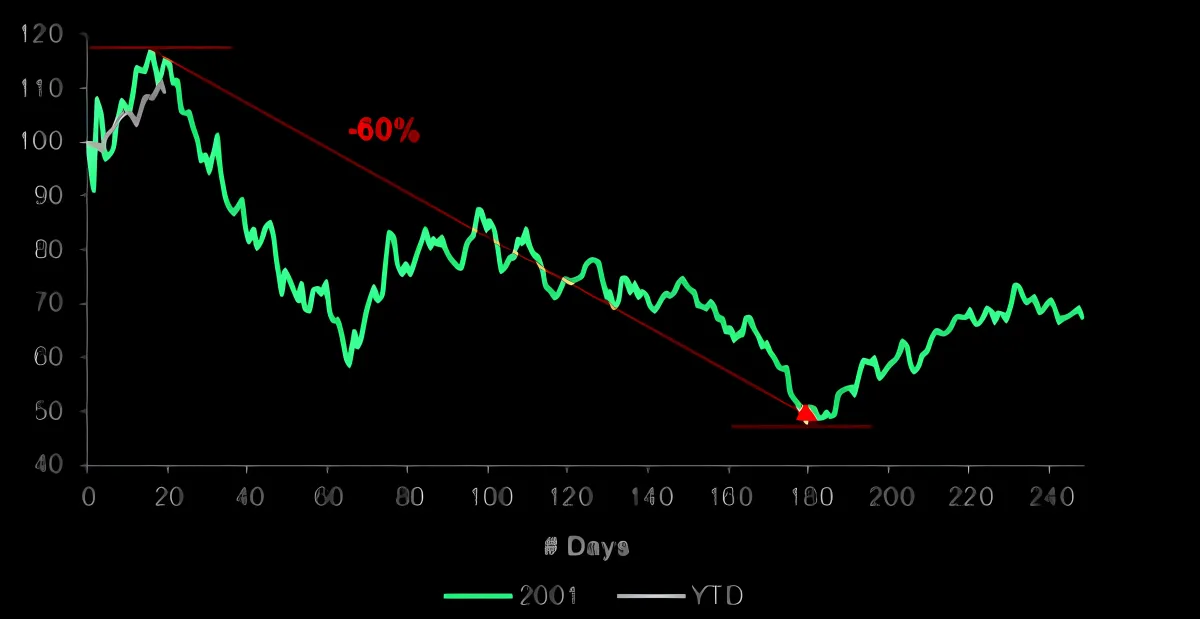

Nasdaq 2023 or 2001

At the beginning of 2001, investors were unsure of what to expect. NASDAQ had experienced significant multiple contractions in the previous year. January ended with a 10% increase followed by a 50% downward trend, financial losses far greater than anyone had anticipated

SPX500 Take profit/Fade target

Here is where I am interested in potentially trying to fade the SPX500 with small orders to test the waters

Please read the previous post: https://www.romanornr.io/market-research-jan-25-2023/

I am keeping the newsletter short this time; the day moved fast, and I may have to wake up early to write these newsletters.

I will try to write a longer newsletter but more in-depth, also covering crypto and airdrops again.

In case you missed the previous newsletter and airdrops, mentioning once again

Filecoin airdrop

The Filecoin EVM chain is a powerful network that is currently underutilized. To start using the network, CollectifDAO is a great option.

It's a liquid staking protocol that serves a dual purpose - it operates as both the Filecoin testnet and a platform for issuing Liquid Staking Derivatives (LSDs).

Liquid Staking Derivatives (LSDs) are a type of financial instrument that allows users to benefit from cryptocurrency ownership without holding the underlying token. This is done by taking out collateralized loans where the underlying asset is used as collateral.

They can be used for hedging and speculation to gain exposure to the cryptocurrency market without holding the coins themselves. LSDs have become increasingly popular in the decentralized finance (DeFi) space as they offer a way to maximize profits while minimizing risk.

Visit: https://app.collectif.finance/

Add: https://chainlist.org/chain/3141

Testnet filecoins: https://hyperspace.yoga/#faucet (put in address)

Stake 5 FIL for clFIL

Scroll airdrop

Scroll is a testnet that uses zero-knowledge proofs, like the networks employed by zkSync and StarkNet.

You can get some test funds from the Faucet tab, bridge funds between networks with the Bridge tab, and swap some funds via the Swap tab.

Scroll is actually two separate networks, so you will need to get funds for both networks separately or use the bridge to transfer funds from one network to the other.

It's a bit confusing, but here's a video I made that might help

Blockwallet

I've been recommending Blockwallet in several tweets.

I made the switch from Metamask to Blockwallet.

The user interface and functions are much better; it works better with my Trezor and switching between accounts. Extra privacy, flash bot protection & anti-phishing. You can also import your Metamask seed, etc.

However, I've seen one of their latest tweets, BlockWallet has a token called "BLANK"

Kicking off the new year with some heat - the $BLANK token burn 🔥 pic.twitter.com/rm83xOo0wt

— BlockWallet 🔲 (@GetBlockWallet) January 16, 2023

If I were a betting man, which I am. I will assume that Blockwallet users are eligible for a nice airdrop. I would recommend installing Blockwallet and making some transactions.

You can export your Metamask seed and import it into Blockwallet. There's no need to reshuffle your assets etc., as some people think. Some people don't want to make the switch because Blockwallet has no mobile app right now. It doesn't matter. You can install Metamask or 1inch wallet on your phone and import your seed on your mobile wallet, which is not Blockwallet.

Chrome extension link: https://chrome.google.com/webstore/detail/blockwallet/bopcbmipnjdcdfflfgjdgdjejmgpoaab

Gtrade

I've noticed this interesting DEX. So gTrade has a really nice UI but also has forex and stocks. I am still playing with the DEX. I recommend using the Polygon network to trade on the.

Again, switching from network and bridging is easy with blockwallet

Apex Dex by ByBit

Reminder Apex incentive program, which pays you to trade and keep tour trade open, is ongoing.

They pay rewards to keep that position open lmao

— Romano (@RNR_0) January 12, 2023

Grand idea (however, maybe it won't work)

Use 1 wallet to long x amount

Use 1 wallet to short same amount

Farm rewards neutral?

Discount ref link code: https://t.co/JsJlHH5k3s

Ref code = 46

disclaimer: I hold 1 ApeX OG NFT pic.twitter.com/SgtbrREWS6

Think I can close it for a moment now

— Romano (@RNR_0) January 16, 2023

I like trading on Apex. I get rewards in BANA tokens as a reward

Basically, 1/3 position size as a reward/incentive to trade@OfficialApeXdex is a DEX from ByBit

Interface identical

Can recommend trying out https://t.co/JsJlHH5RT0 pic.twitter.com/Le0Y0y8X9d

If you need a referral link: https://pro.apex.exchange/trade/BTC-USDC/register?affiliate_id=46&group_id=83

My referral code is: 46

In my opinion, this is the best DEX for trading bitcoin futures.

They also have a mobile app, Android:

Also, an app for iPhone

Ref code = 46

Become an affiliate of this newsletter.

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me, as compensation for promoting/sharing the newsletter with others.

Payouts can be in crypto or through a bank.

Newsletter affiliate

Receive 50% of the recurring commission every month

Basically, you get a revenue split, which seems fair to me as compensation for promoting/sharing the newsletter with others.

I will try to sleep earlier so I can write earlier in the day; checking the market in the morning is a bit easier to prepare for the day; also, writing these newsletters takes a lot of time.