Market Insight June 12

The ECB is the European Central Bank, and Lagarde is the current President. The ECB can set interest rates for the Eurozone, and Lagarde's comments suggested that the ECB is planning on hiking rates soon to combat energy-driven inflation.

That is not an unprecedented decision, as the ECB has hiked rates before when inflation has been a concern. However, given the current state of the economy - with growth being low and sentiment being negative - it is a somewhat risky move. It remains to be seen how markets will react to this news.

Gotta love the ECB... If at first you don't succeed, Tri... Tri... Trichet again... pic.twitter.com/A8ORVn4hRW

— Michael (@profplum99) June 9, 2022

The quarterly option expiry is also just a week away, so there could be some volatile intraday moves for the week.

JP Morgan Bitcoin flow pace

We will have to wait much longer for JP Morgan's Bitcoin flow to pick up the pace. Inflows have remained depressed, and given the recent weekend price action in the market, it is doubtful that people are eager to add to assets that are seeing a lot of volatility.

Likely, most asset managers are still trying to figure out how to deal with the volatility in the equity markets before they add any more Bitcoin to their portfolios.

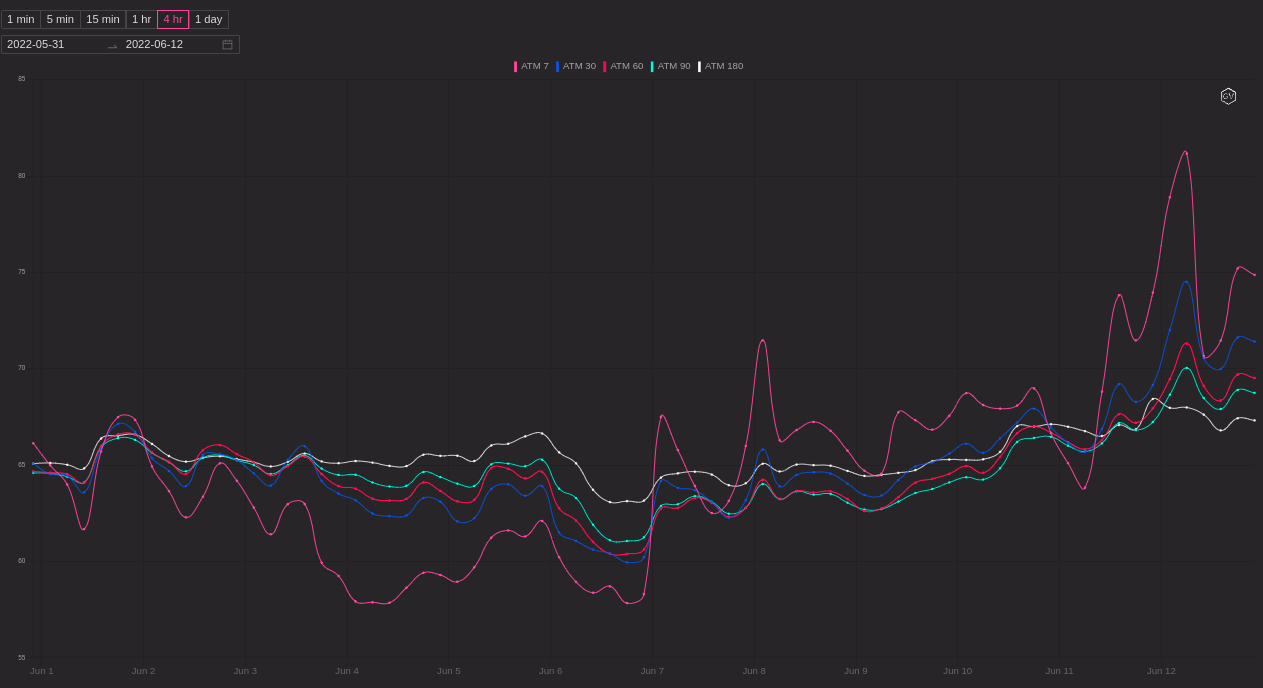

Bitcoin Volatility

The volatility of Bitcoin surged over the weekend, with the biggest move seen in short-term maturities.

Bitcoin skew

The skew measures the difference in the implied volatility of put options and call options. A positive skew indicates that put options are more expensive than call options, while a negative skew indicates the reverse.

The skew for the 7day is at -9 vol points, suggesting that investors were willing to pay a premium for put options

That might mean that market participants expect the price of Bitcoin to fall in the future.

The August and September skew is particularly notable, indicating that people expect the price to fall more in these months, and they are hedging for it.

Ratio put spreads remain an attractive downside hedge if you believe we will continue to go down even more.

A ratio put spread is an options strategy that involves buying one put option and selling multiple put options with a lower strike price so that the number of options sold is greater than the number of options bought.

The strike price of the options bought must be lower than the strike price of the options sold. This strategy is used when the investor believes that the underlying asset will fall in value but is unsure of how far it will fall.

Now, if we look at the dynamics, there's a lot of put option demand for Bitcoin, ethereum, SPX500, etc.

When there is demand for put options, market participants expect the underlying market (in this case, the S&P 500 index) to fall.

The market makers/dealers will be in the opposite position because they sold those put options to market participants who market-bought those put options from them.

That will generally result in losses if the S&P 500 falls in value, since the value of those put options will increase as the S&P500 declines.

However, these losses will be exacerbated if the S&P 500 falls further or if volatility increases (volga risk) because market makers must remain delta-hedged and can delta-hedge put options by short-selling the underlying (S&P500 in this case). After all, the value of put options is sensitive to both factors.

Volga is the rate of change of an option's price with respect to changes in volatility. For instance, an option with a high volga will increase in value as volatility increases. That is because options are more valuable when there is more market uncertainty.

Rallies/pumps into June 17th OPEX should be labeled as "short covering" and are prone to failures.

June 15h VIX expirations